26+ Compound interest mortgage

It uses this same formula to solve for principal rate or time given the other known values. Here in the United States mortgages use simple interest meaning it is not compounded.

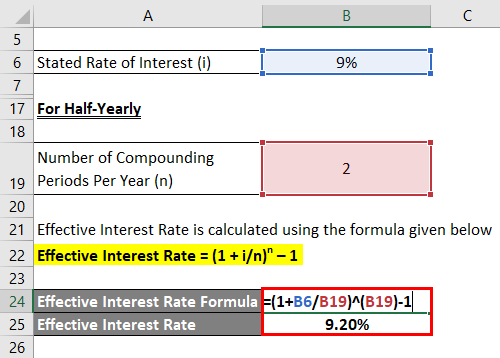

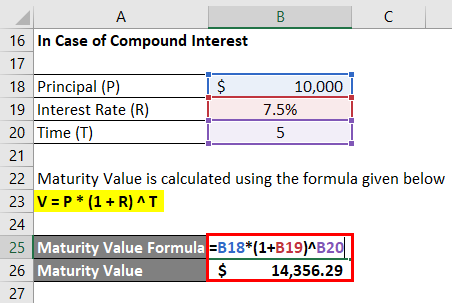

Effective Interest Rate Formula Calculator With Excel Template

Use this handy mortgage calculator to work out the monthly costs and the total cost including the interest of a capital repayment or interest only mortgage.

. Length of time in years that you plan to save. Choose The Loan That Suits You. It is easier for them to form a habit of taking a portion from each paycheck to make mortgage payments.

With 52 weeks in a year this amounts to 26 payments or 13 months of mortgage repayments during the year. On your 800000 mortgage at a 4 percent interest rate with a monthly payment of 479900 you would divide the annual interest rate by 365 and apply it to the mortgage balance. If you have a balance of 1000 and an interest rate of 1 youd.

Lock Your Rate Now With Quicken Loans. The term commercial is used to distinguish it from an investment bank a type of financial services entity which instead of lending money directly to a business helps businesses. Similarly the larger the loan the better compound interest is for the borrower.

Learn more about compound interest here. They are both rate hunters who keep an eye on the market for conditions they can take advantage of. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Compare Low Rates Save Your Money. For example you might want to calculate mortgage interest for a mortgage of 500000 with monthly payments of 2500 at a 3 mortgage rate. Compound interest investors and mortgage borrowers have something in common.

Compound interest also known as interest on interest works in the same way. The small 1000 loan version over five years given in our example showed a saving of almost 200 close to 20 of the principle. Homeowners who carry a mortgage on their properties will look for signs of lower interest rates so that they can apply for refinancing.

Mortgage compound interest means additional interest has been added to the initial loan. Department of Banking and Insurance. Rocket Mortgage LLC 1050 Woodward Ave Detroit MI 48226 Licensed Mortgage Banker-NYS Department of Financial Services.

However it will make a sum grow faster than simple interest which is. The total amount both principal and compounded interest P. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to withdraw every month.

The compound interest of the second year is calculated based on the balance of 110 instead of the principal of 100. Apply Easily Get Pre Approved In 24hrs. Ad Top-Rated Mortgage Companies 2022.

In this case the. The total compound interest after 2 years is 10 11 21 versus 20 for the simple interest. The longer a loan goes on the better an alternative compound interest is to simple interest.

Compound interest helps you save more faster. Get Top-Rated Mortgage Offers Online. This creates an additional 2 bi-weekly mortgage payments or the.

You can also use this formula to set up a compound interest calculator in Excel 1. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Length of Time in Years.

B P x 1 RN N x T Each component of the formula stands for. A Accrued amount principal interest P Principal. Thus the interest of the second year would come out to.

A relatively straightforward mathematical formula can be used to calculate the total sum of compound interest that will be paid on a mortgage loan. Conversely think of an everyday saving account that offers you compounding interest. There are 52 weeks in a year which will result in 26 bi-weekly mortgage payments.

Get All The Info You Need To Choose a Mortgage Loan. Now is the Time to Take Action and Lock your Rate. For example if you have a 100000 simple mortgage loan with a 5-year term at 1 annual interest then you can expect to pay 1000 every year on interest for a.

This calculator uses the compound interest formula to find principal plus interest. Use the following formula to find out your compound interest mortgage repayments. We Found The Best Housing Loan Lenders For You.

The compounding feel comes from varying principal payments. So there is no interest paid on interest that is added onto the outstanding mortgage balance each month. Ad Best Housing Loans Compared Reviewed.

This means that while you might be making monthly mortgage payments your mortgage interest will only be compounded twice a year. In a simple interest mortgage the interest in the first period wont affect the interest in the second period. The interest on a loan or deposit calculated based on both the initial amount and previous interest payments from previous periods is known as compound interest or compounding interest.

A typical home mortgage is still a simple interest loan even though it feels like compound interest. 110 10 1 year 11. A P1 rn nt.

Simply enter the total capital required for your home loan the term of the mortgage and the interest rate. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. The Compound Interest Formula.

Compound interest and your mortgage. Toggle Navigation 888 452-0335 Apply Now. Compare Lowest Mortgage Lender Rates 2022.

888 474-0404 Licensed by the NJ. The formula is as follows. Mortgage interest in Canada is compounded semi-annually.

What does this factor mean in a mortgage loan. Calculating compound interest is actually quite simple. Ad Were Americas 1 Online Lender.

An explanation of the two different types of mortgage can be found here. When compounding interest on mortgages you pay interest on top of interest. If you dont let the principal payments vary as in an interest-only loan zero principal payment or by equalizing the principal payments the loan interest itself doesnt compound.

This method is mainly for those who receive their paycheck biweekly. If you dont want to deal with compound interest most traditional loans offer simple. The longer unpaid loans sit the more interest will accrue.

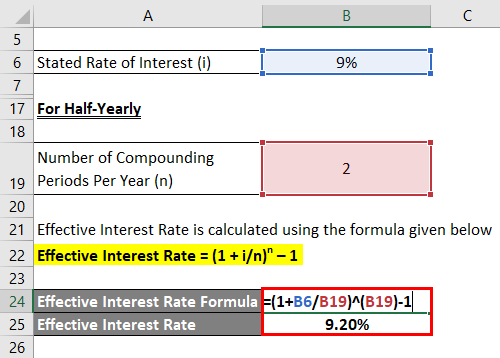

Trend Analysis Formula Calculator Example With Excel Template

Cash Flow Formula How To Calculate Cash Flow With Examples

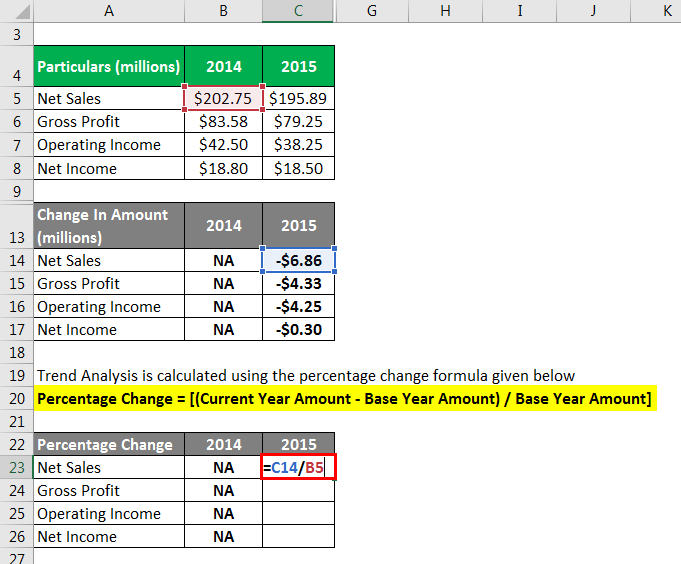

Maturity Value Formula Calculator Excel Template

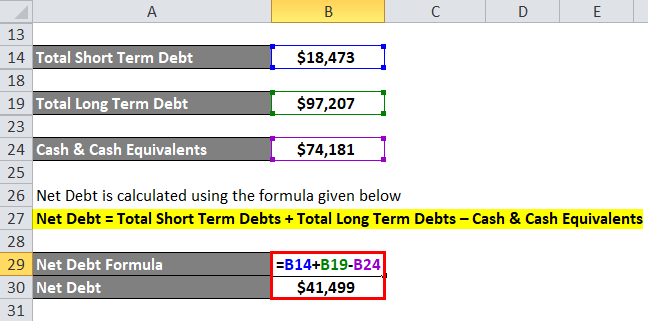

Net Debt Formula Calculator With Excel Template

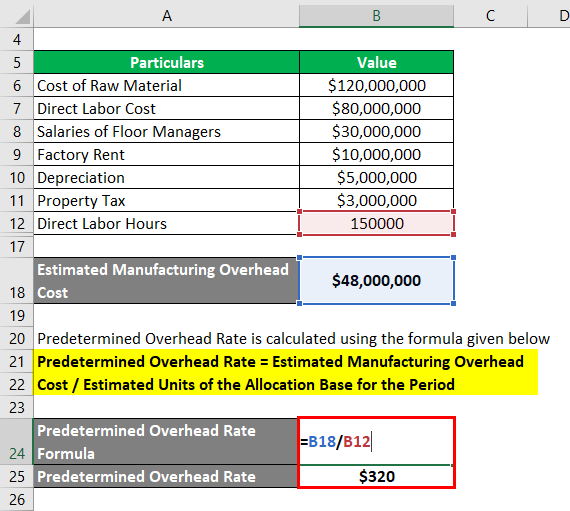

Predetermined Overhead Rate Formula Calculator With Excel Template

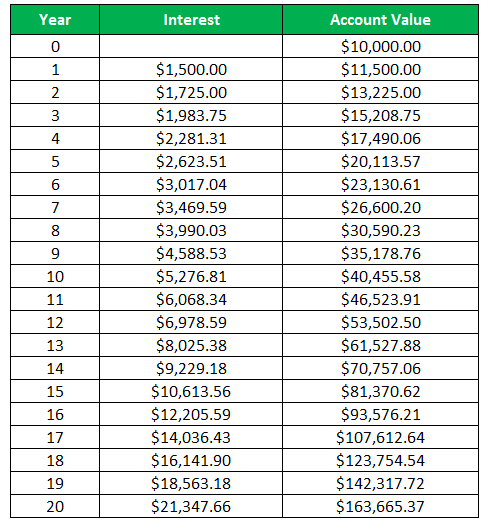

Compound Interest Example Practical Examples With Formula

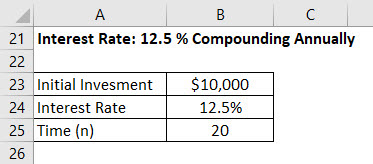

Calculate Compound Interest In Excel How To Calculate

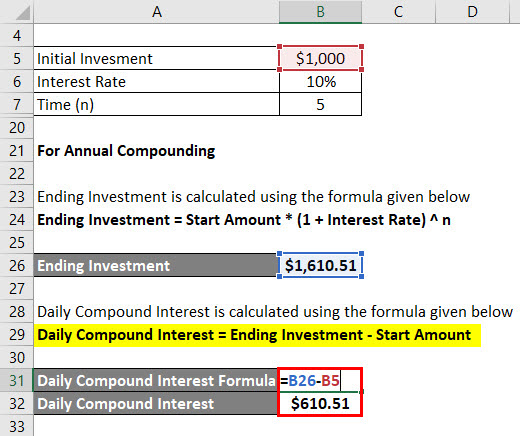

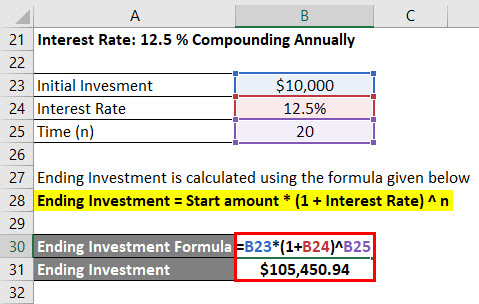

Daily Compound Interest Formula Calculator Excel Template

Daily Compound Interest Formula Calculator Excel Template

Private Loan Contract Template Lovely 28 Loan Contract Templates Pages Word Docs Private Loans Contract Template Personal Loans

Daily Compound Interest Formula Calculator Excel Template

Maturity Value Formula Calculator Excel Template

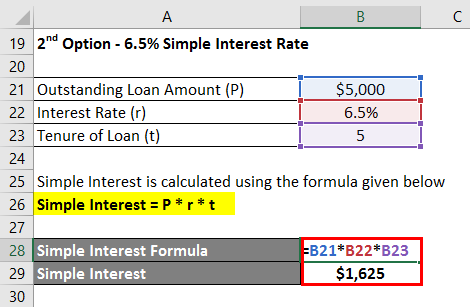

Interest Formula Calculator Examples With Excel Template

Free 6 Sample Agreements For Labour Contract Templates In Ms Word Pdf Contract Template Contract Agreement Ms Word

Common Stock Formula Calculator Examples With Excel Template

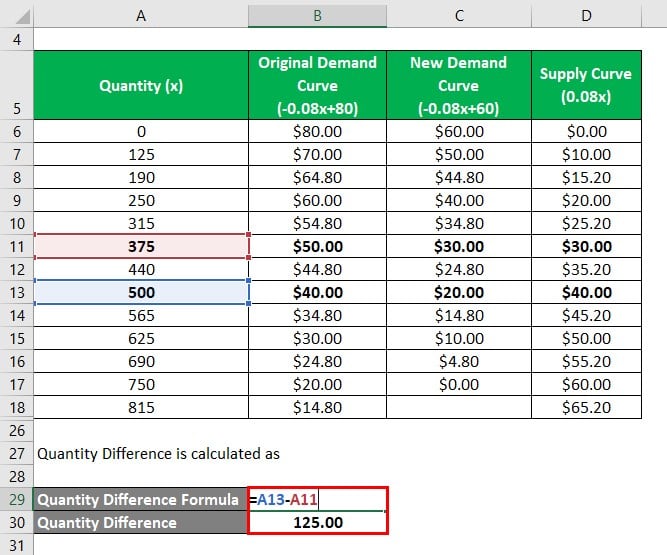

Deadweight Loss Formula How To Calculate Deadweight Loss

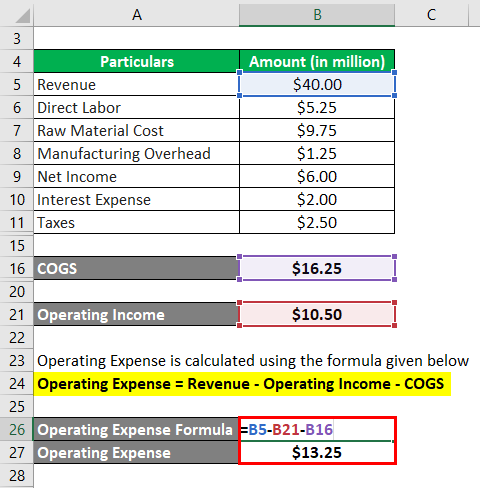

Operating Expense Formula Calculator Examples With Excel Template